The Psychology of Finance

By Alex Slivka

“…An uncertain path from one paradigm to another.”

– Innovation as defined by Thomas Kuhn,1962.

Change has transformed financial markets in my lifetime. We have seen dramatic changes in the way people invest their money and how those investments are measured and constructed.

In the beginning

I attended college 35 years ago (1978-82), graduating with a degree in economics and an interest in financial markets and psychology. These years were notable for the volatility of markets and economies both in the United States (U.S.) and across the globe.

My studies in financial markets was the traditional contemplation of inputs (inflation, employment, interest rates, political policy) that might predict economic trends, and the study of balance sheets and income statements for clues regarding specific company performance. It was all very precise, mathematical, and unemotional. People acted to maximize their utility, that is, to always prefer more money.

At the same time, my study of psychology was a disappointing exercise in memorization, where author-specific terms seemed to be the only difference between Freud, Maslow, Titchener, Pavlov, Skinner, Adler, and Jung as they struggled to define a framework that could explain human behavior.

Both fields asked the same question: Can we create a framework to explain the past and predict the future? Some might call this the perennial quest of humanity, i.e., searching for apparent cause and effect even after an exact study proves the reasoning to be false. Daniel Kahneman and Amos Tversky demonstrated with a multitude of observational experiments that people’s behavior was a long way from rational. Much of this work was brought together in their landmark 1977 article in the journal Science, Judgement under Uncertainty: Heuristics and Biases.

Benoit Mandelbrot’s work was similar, using his framework of fractal geometry to generate models that could replicate dynamic systems like financial markets, weather, and turbulence.

Forty years later, Kahneman, Tversky, and Mandelbrot transformed our understanding of most every system, especially financial markets.

At work

At the core of the financial markets there are just two types of investments of investments: equity (where you are the owner) and debt (where you are the lender). In 1978, we were only 45 years past the worst of the Great Depression, and the memories of tragic losses still lingered.

In 1977, securitization of bonds and mortgages began, when Lewis Ranieri, working at Salomon Brothers, was the first person to package a pool of loans and sell them as an investment. Securitization has exploded throughout the past 40 years, financing a global expansion unlike any in history. Unfortunately, it was also the source of the Global Financial Crisis of 2007-2009.

The years since 1980 have seen a dramatic expansion of opportunity to participate in growth around the world. Working at McKinley Capital has given me a front row seat to this growth and the positive benefits it has bestowed on all Alaskans. In 1980, the Permanent Fund had less than $500 million in assets. Today, those assets are worth over $65 billion.

Where are we today?

Whenever the stock market falls, people always try to explain why. The honest answer is nobody really know why the stock market rises and falls on any given day. There can be any multitude of unknown factors that lead to stock price increases and decreases. Maybe it snowed in New York. Maybe Donald Trump tweeted. Maybe a Credit Suisse VIX ETF blew up. Who knows? The needle can move for lots of reasons.

The one thing we know for certain is that prices move because one side of the equation (buyers or sellers) is more eager than the other. Again, we don’t really know why that is, but it’s the only thing that causes prices to change.

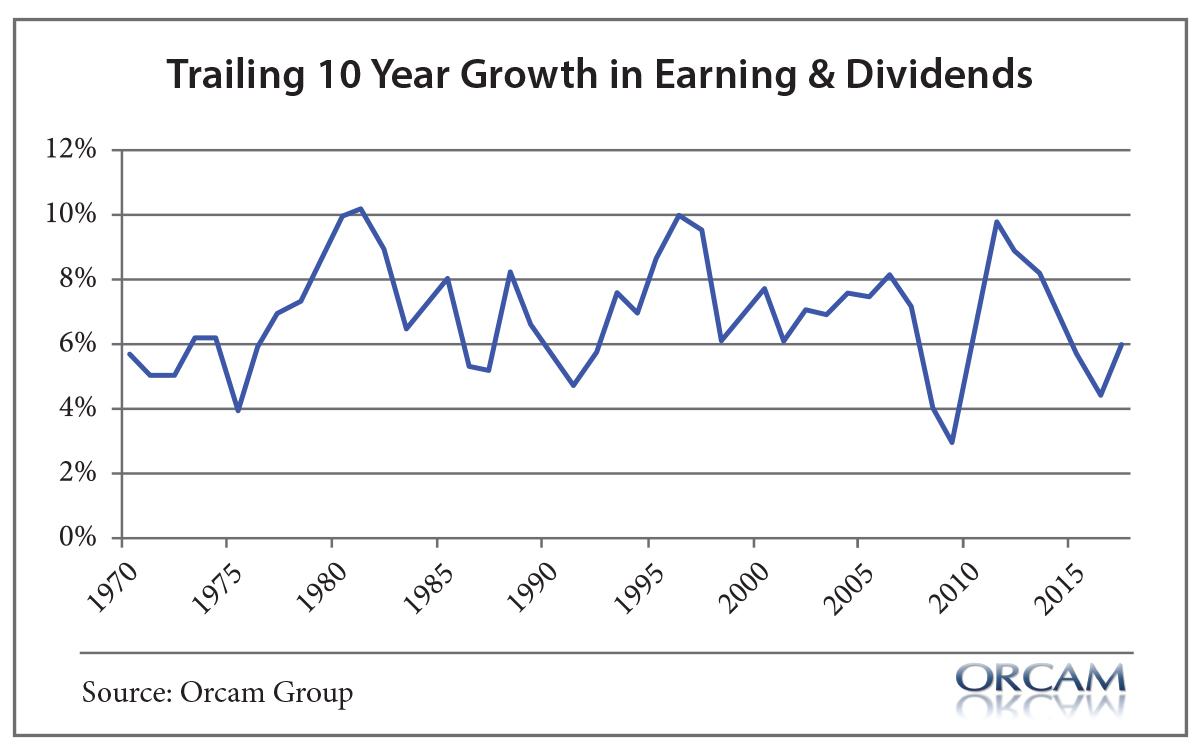

The interesting thing about stocks is that they generate surprisingly stable earnings and dividend yields. Here’s the trailing 10-year growth in earnings and dividends through the end of 2017:

In other words, when there is no change in multiples, stocks have pretty consistently earned 4-10 percent in earnings and dividends. That’s a fairly reliable 7 percent earnings and dividend yield. So, we can guess that stocks will probably go up more often than not because the underlying entities earn cash flows that mathematically lead to higher prices. If you hold stocks for a long time, the odds of benefiting from that positive earnings and dividend trend is pretty high1.

As market conditions change, we are always guessing what that should mean for current prices. If the stock market goes up 20 percent many years in a row, then the market is earning much more than its average. The longer it does that, the higher the probability is that it’s unsustainable. The same process works in market declines. The longer they last (2000-2003 & 2007-2009) the greater the likelihood for an upturn.

The stock market can’t mathematically earn 20 percent every year. And sometimes it overshoots or undershoots that average 7 percent because earnings can fluctuate with economic conditions. But the thing that you’ll notice consistently about big market declines is that they’re almost always preceded by big increases. In other words, we sometimes think the market is going to earn more than that 7 percent, so we bid prices way up at an unsustainable rate and then reality hits us over the head and the market corrects to adjust back toward the average rate of return.

Conclusion

The dichotomy of the financial markets is that most of the time the vast framework of mathematical precision roughly approximates what is observed in the market. The challenge is that these long periods of calm are punctuated with uncertain timing by “abi-normal” periods where risk and volatility expand with breath taking speed, as demonstrated in 2008 and again here in 2018.

Everyone wants a fancy-sounding story for why the stock market goes down, but in most cases, it’s as simple as “because it went up a lot.”

1Cullen Roche; Pragmatic Capitalism blog

Alex Slivka, Director of Institutional Marketing, McKinley Capital Management, LLC, has worked in the financial markets for more than 35 years. He managed a retail brokerage firm based in Seattle for 14 years before moving to Anchorage, Alaska, in 1997. For the past 21 years he has worked for McKinley Capital Management LLC, and has been an industry arbitrator with the NASD (now FINRA) for more than 20 years.

A member of the Rotary Club of Anchorage (past president), he is active in the community. He currently chairs The Eyak Permanent Fund Settlement Trust, The Investment Advisory Commission for the Municipality of Anchorage, the Investment Committee for the Alaska Community Foundation (past Board Chair), the McKinley Capital 401k Savings Plan, the University of Alaska Foundation, and is a member of its Investment Committee.

Alex Slivka

Director of Institutional Marketing

McKinley Capital Management, LLC